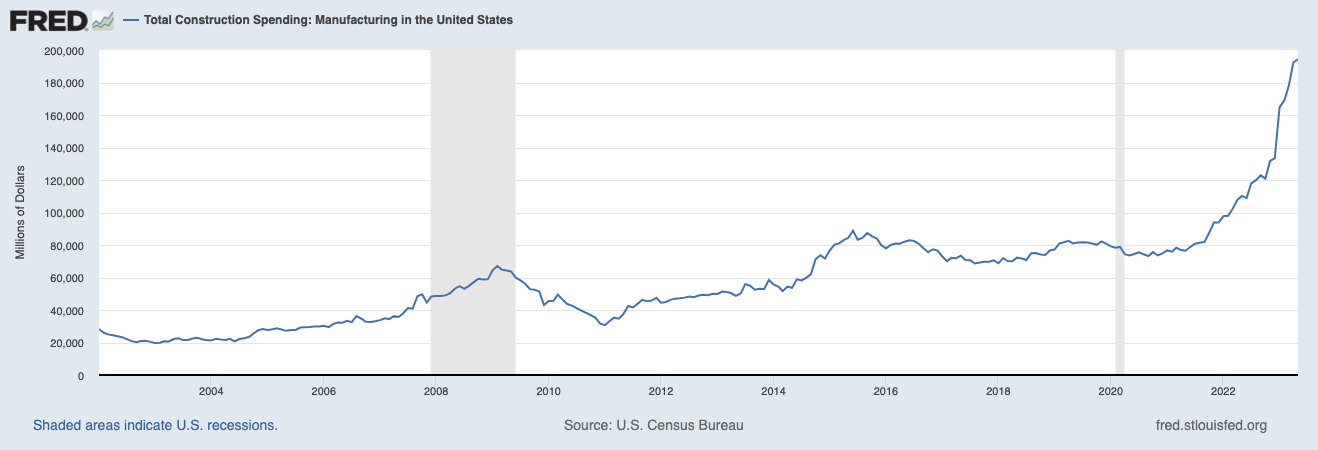

Many industry experts believe the U.S. is in the early stages of a manufacturing investment supercycle. U.S. manufacturing construction spending reached a 20-year high, hitting a $194 billion annual rate in April 2023, nearly double the $107 billion annual rate from a year ago, according to the Federal Reserve.

Spending in the U.S. increased in the last few years as legislation, including the CHIPS Act, Inflation Reduction Act and the Infrastructure Law, was allocated to support manufacturing and related projects.

Many companies are rethinking and rebuilding their global supply chains after the pandemic, and the U.S. is now the destination for foreign corporate investment. According to this recent Business Journal article, the U.S. attracted 23% of total foreign direct investment, up from 15% one year ago.Global companies are looking to build large-scale facilities in the United States and the trend is expected to extend well into the second half of the decade.

Much of the investment is occurring in renewable energy, electrical vehicles and batteries/charging stations, semiconductors, as well as more traditional areas including ports, highways, grids and airports.

For example, Ford Motor Co. plans to build three electric battery factories that will supply its expansion into electric vehicles. Ford plans to make as many as 2 million EVs by 2026, a 152% growth compared to its production in 2022.

This increased investment will likely mean continued workforce demands and increased need for raw materials, while providing a barrier to economic recession due to the foundation of activity it will create under traditionally volatile industries.

>> Learn why the

Kansas City region is the ideal location for manufacturing and distribution operations.