Missouri

Enhanced Enterprise Zones are specified geographic areas designated by local governments and certified by the Missouri Department of Economic Development (DED). Individual business eligibility will be determined by the zone based on the creation of sustainable jobs in a targeted industry or demonstrated impact on local industry cluster development. Gambling establishments, retail trade, food and drinking places, educational services, religious organizations, and public administrators are prohibited from receiving the state tax credits. Service industries can be eligible if a majority of their annual revenues will be derived from services provided out of the state. DED will consult with the local government in determining eligibility.

See the Job Creation Incentives section below for detailed information about the Missouri Works program.

The Federal Opportunity Zone Program is a tool to accelerate community and economic development with the goal of driving long-term private investment into low-income areas throughout the country.

The benefit is threefold to investors placing their capital in the Qualified Opportunity Zones:

Temporary, capital gain tax deferral

- The period of capital gain tax deferral ends 12/31/2026 or upon an earlier sale

Increase in basis

- Investment held for 5 years – basis increased by 10% of deferred gain (90% taxed)

- Investment held for 7 years – basis increased by another 5% of deferred gain (85% taxed)

Forgiveness of additional gains

- Investment held for 10 years – Basis equal to fair market value; forgiveness of gains on appreciation of investment of sale or exchange of Opportunity Fund investment. This exclusion only applies to gains accrued after an investment in an Opportunity Fund.

There are two main pieces of the Opportunity Zone Program that make it work: zones and funds.

Zones

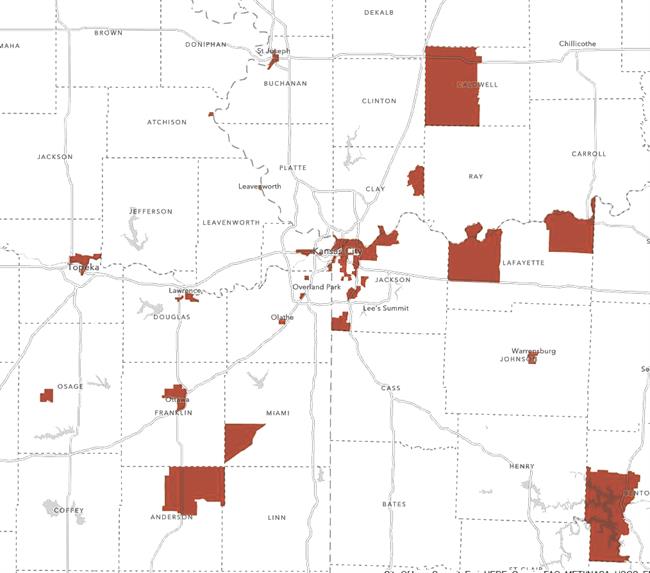

Opportunity Zones are economically distressed Census Tracts that have been qualified as being eligible to participate in the program by the U.S. Treasury. There are 72 Qualified Opportunity Zones in the KC region. To see all eligible Opportunity Zones, visit this interactive map.

KC Region | Qualified Opportunity Zones

Funds

To obtain the tax benefits under the program, an investment in an Opportunity Zone must be done through a Qualified Opportunity Fund. A Qualified Opportunity Fund is an investment vehicle that is set up as either a partnership or corporation for investing in eligible property that is located in a Qualified Opportunity Zone and has no cap. Any entity will be able to self-certify as being an Opportunity Fund without approval or action by the IRS and only needs to file a form attached to the investor’s tax returns.

Additional Opportunity Zone Information

INFORMATION FOR BOTH KANSAS AND MISSOURI IS PRESENTED BELOW.

Kansas, Bond Financing

Industrial Revenue Bonds

Industrial revenue bonds (IRBs) are among the most popular and cost-efficient methods of financing up to 100% of a growing business' land, buildings, and equipment, with the only equity requirement being the cost of bond issuance. IRBs are securities issued by cities and counties to provide the funds for credit-worthy companies to purchase land, to pay for the cost of constructing and equipping new facilities, or for purchasing, remodeling, or expanding existing facilities. Other developmental and financing costs, such as engineering, architectural, legal, and bond underwriting costs, may also be financed from bond proceeds.

A business leases the project facility from the bond issuer, then rent payments are used to pay the principal and interest to the bond holders. When all bonds have been paid, the business may assume title to the project for a nominal price, such as $100. Lease/purchase financing permits the business to take advantage of applicable depreciation guidelines, receive available tax credits, and deduct interest payments as a business expense.

Most bonds are structured over 10-15 years. Principal repayment terms are flexible and can be structured to suit a business' specific cash flow needs. The bonds are usually not callable before the third or fourth year.

Certain projects are eligible for tax exempt financing. When tax exempt IRBs are issued, the interest received by IRB holders is exempt from federal and Kansas income tax, and as a result, the cost of financing the project is below conventional costs. Tax exempt financing is available for manufacturing facilities, as well as for a variety of utility, transportation, and other public infrastructure projects. Up to $10 million of tax-exempt IRBs can be issued to finance office, distribution, manufacturing and R&D facilities.

Whether a project is financed through tax exempt or taxable IRBs, Kansas law exempts the project from real and personal property taxation for up to 10 years. Issuers can require that all, or a portion of, the abated taxes be made available to local taxing jurisdictions in the form of "payments in lieu of taxes." Nearly every IRB issuer will also provide partial property tax abatements as an additional incentive to companies for locating in the community. The cost of building materials and labor, as well as fixed items of machinery and equipment, is exempt from state and local sales taxes.

Kansas Development Finance Authority

The Kansas Development Finance Authority (KDFA) is authorized to issue bonds, either for a specific activity or on a pooled basis. KDFA may issue bonds for financing capital improvements, industrial enterprises, agribusiness enterprises, educational facilities, health care facilities, and housing developments. It may also issue bonds to finance an interest, such as lease or mortgage, on such facilities. The Authority may also help establish and fund venture capital funds.

Any bonds issued by the Authority and the interest paid thereon, unless specifically declared to be taxable in the authorizing resolution, are exempt from all state, county, and municipal taxes. The exemptions include income, inheritance, and property taxes.

Bond Finance Program for Aviation Projects

The Kansas Development Finance Authority are authorized to issue bonds for large aviation projects. An eligible aviation business is defined as a company engaged in the aviation manufacturing or service industry, paying at least $150 million in annual gross wages, paying at least a $50,000 average annual wage and invested at least $500 million in real and personal property in Kansas.

An eligible aviation project is a research, development, engineering or manufacturing project for which the company proposes to invest at least $500 million and employ up to 4,000 full-time employees. The Kansas Development Finance Authority would issue bonds for a principal amount of up to $33 million for a single aviation project with a $150 million cap for all projects.

The maximum term of the bonds is typically 20 years. The normal income tax withheld from the employee's wages is used to pay back the principal and interest on the bonds. If the company receives project benefits from this program, they are not eligible to also participate in IMPACT.

Missouri, Bond Financing

Missouri BUILD Program

Major projects that meet certain investment and job creation requirements may receive assistance through the Missouri BUILD (Business Use Incentive for Large-scale Development) program. BUILD is a selective and competitive program reserved for use with large projects that bring significant investment and jobs that benefit the community and state economies. The program uses bond financing for public or private infrastructure or new capital improvements of the business at the project location. Companies in the BUILD program realize the benefit of the program through refundable state tax credits issued to the company that are equal to the amount of annual debt service payments on the bonds, over a period of 10-15 years.

Municipalities

Cities or counties may purchase or construct projects with bond proceeds and lease or sell the project to a company. The bonds may be issued as a "revenue" bond or a "general obligation" bond. General obligation bond issues require a two-thirds public voter approval. Revenue bonds do not require a bond approval election. Municipal IRBs can be issued to provide funds to purchase, construct, expand or improve industrial plants. The bonds can be sold as federal and state tax-exempt, if the project is less than $10 million, and if the company has less than $40 million in outstanding tax-exempt bonds, and the company is a manufacturer. It may be possible to exempt most of the real and personal property tax of bond-financed buildings and machinery if the city or county owns the property and leases it to the company.

Kansas, Infrastructure Financing

Tax Increment Financing

Tax Increment Financing (TIF) is a real estate redevelopment technique, applicable to industrial, commercial and residential projects. TIF covers the costs of publicly provided project improvements by using the anticipated increases in real estate tax revenues to retire the bonds sold to finance qualifying redevelopment costs.

The advantages of TIF for business include 1) financing of land acquisitions and improvements with tax-free borrowing, thus reducing interest costs, and 2) offering the opportunity to purchase renovated sites and/or buildings at sub-market costs.

Moneys raised through TIF can be used for initiatives selected and administered by local governments, such as land acquisition, land and building cost subsidies, structure rehabilitation, and public improvements.

TIF works for both privately-owned land and publicly-owned land to be sold for redevelopment. It is available only if private redevelopment would not occur without public improvements. TIF cannot be used speculatively to prepare a site for development.

Applicable to redevelopment financing as well.

Community Development Block Grant Funds

Eligible small cities and counties may apply for Community Development Block Grant (CDBG) funds for water, sewer or other infrastructure improvements to assist new or existing companies create or retain jobs. Funds may also be used to provide direct financial assistance to firms for the acquisition of land or buildings, construction or renovation of facilities, purchase of machinery and equipment, infrastructure improvements, and/or working capital. The interest rate is currently set at 3 percent below prime or 4 percent, whichever is greater. The term of the loan is based on the asset being financed - working capital loan is up to 5 years, machinery and equipment is up to 10 years and real property is up to 15 years. For business loans, a match is required of $.50 to every $1 of CDBG funds.

Funds are awarded on a competitive basis, providing low-interest subordinated loans to business or communities for public infrastructure needs. Projects are expected to create or to retain jobs for low and moderate-income persons.

The maximum economic development block grant award is $35,000 per job created or retained. The maximum CDBG grant available is $750,000. At least 51% of the jobs created must meet HUD's low-and moderate-income standard for the county in which the project is located.

CDBG loans are individually structured during negotiations with the company and local and state officials. Local governments receive the grant funds and in turn loan them to the company, with flexible interest rates (from 0% to prime) tailored to the company's needs and cash flow. A low dollar/job creation ratio and complete recapture of grant funds by the community increases the project's funding potential. Loan guarantees and interim financing are also available for economic development projects on an open window basis.

Missouri, Infrastructure Financing

Tax Increment Financing

Tax increment financing (TIF) is designed to help finance improvements to property in designated redevelopment areas using the tax revenues that result from improvements to those areas. Any city or county in Missouri may designate redevelopment projects and adopt TIF by passage of local ordinances.

Up to 100% of the increased amount of real property taxes and 50% of local sales, utility, and (in Kansas City) earnings taxes resulting from improvements in a redevelopment area are paid in lieu of taxes into a "special allocation fund." Additionally, up to 50% of state withholding taxes or 50% of state general sales taxes (1.5%) generated by a TIF project may supplement local TIF funding. The amount of redevelopment project costs funded and the length of time local taxes are redirected into the fund (up to 23 years) is negotiated by the local TIF commission based on the least amount to cause the project to occur. TIF project funds may be derived from a bond issue (paid from the net new local taxes), or a reimbursement to the developer for approved costs.

Eligible redevelopment project costs are defined very broadly and include, in part: the costs of studies, surveys, plans and specifications, land acquisition, land preparation, professional service costs and fees, and construction costs of both public and private improvements.

Applicable to redevelopment financing as well.

Community Development Block Grant Program (CDBG): Industrial Infrastructure Grant

When eligible sites have certain infrastructure needs (public streets, water or sewer lines, engineering and other public facilities), using the CDBG federal funds available to it, a local community can help reduce or offset costs associated with a given project in a “non-entitlement” area (a city under 50,000 in population or a county under 200,000 in population).

Foreign Trade Zones (FTZ) Numbers 15 and 17 in the Greater Kansas City area make up the largest FTZ in the U.S. with five manufacturing zones (123.4 acres), nine general purpose FTZ sites, with over eight million square feet of active FTZ space, and 13,000 plus acres of inactive FTZ space available for storage and/or processing of merchandise. Kansas City's manufacturing, processing, and distribution FTZs support a variety of activities in animal health and crop science processing, motor and implement manufacturing and assembly activities, textile and apparel industries and related value added work as well as import, kitting, and distribution of sports-related consumer products and apparel. Located in the geographic center of the U.S., with market coverage of 155.6 million consumers within 16 hours driving time, the underpinnings of Kansas City's reputation as a growing trade hub is its significant highway, rail, air and other transportation infrastructure. Kansas City's FTZs handle more volume than those in Dallas/Ft. Worth, Denver, Minneapolis, Oklahoma City, Tulsa, and St. Louis.

The trade zones program in the Greater Kansas City area is operated by the Greater Kansas City Foreign Trade Zone, Inc. (GKCFTZ). Kansas City was the first inland area to be granted the right to operate a FTZ and the first administered by a private, not-for-profit corporation.

The FTZ encourages international commerce and offers businesses many cost saving advantages:

- Under the supervision of U.S. Customs and Border Protection, foreign goods may enter Kansas City's designated FTZ areas free of custom duties and fees for an unlimited period of time.

- While in the zone, goods may be stored, manipulated, mixed with domestic and/or foreign materials, used in a manufacturing process, or exhibited for sale.

- Imported goods assembled or manufactured in a zone may be subject to a lower duty rate. Duty is assessed on the value of the imported parts at the duty rate applicable to the imported parts or applicable finished product, whichever is lower. Duty is not assessed on U.S. labor or materials used in assembly or manufacturing.

- Since there are no time restrictions, merchandise may be stored indefinitely without duty until it is sold and/or moved out.

- Damaged, defective or non-salable merchandise may be destroyed without being subject to U.S. customs duty.

- Merchandise may be exported without being subject to U.S. customs duty.

Kansas City's FTZ recently reorganized their program and operation under ASF regulations which offers many advantages including expedited and cost effective access to the program for all companies, large and small alike, through simpler application processes and shortened application time frames when businesses are locating in existing FTZ space.

To view a list and map of FTZ locations visit the KC SmartPort website.

INFORMATION FOR BOTH KANSAS AND MISSOURI IS PRESENTED BELOW.

Kansas

Angel Investor Tax Credits

Tax credits are offered against Kansas income tax liability for accredited investors making investments in seed and early-stage capital financing for emerging Kansas businesses engaged in the development, implementation and commercialization of innovative technologies, products and agencies.

- The credit is 50% of the investor’s cash investment in the qualified business.

- If the amount of credit exceeds the investor’s tax liability in any one taxable year, the remaining portion of the credit may be carried forward until the total amount of the credit is used.

- The Kansas Department of Revenue will not allow tax credits that are attributable to an individual of more than $50,000 of cash investments in the qualified securities of a single Kansas business for cash investments in the qualified securities of more than five Kansas businesses each year.

High Performance Business Tax Credits

The High Performance Incentive Program (HPIP) provides tax incentives to employers that pay above-average wages and have a strong commitment to skills development for their workers. This program recognizes the need for Kansas companies to remain competitive and encourages capital investment in facilities, technology and continued employee training and education. A substantial investment tax credit for new capital investment in Kansas and a related sales tax exemption are the primary benefits of this program. As of October 1, 2016 HPIP applications require a non-refundable application fee per worksite location to be submitted with the application. The fee schedule per location is as follows: 1) First time certifications - $750; or 2) Re-certifications - $250; or 3) One page carry-forward only - $0. Note: a 2.5% service fee will be applied to online credit and debit card payments, and a $1.50 service fee will be applied to online ACH payments.

HPIP offers employers four potential benefits:

- A 10 percent income tax credit for eligible capital investment that exceeds $50,000 ($1M in Johnson, Douglas, Shawnee, Wyandotte and Sedgwick Counties) at a company’s facility, with a carry-forward that can be used in any of the next 16 years in which the qualified facility re-qualifies for HPIP.

- A sales tax exemption to use in conjunction with the company’s eligible capital investment at its qualified facility.

- A training tax credit of up to $50,000.

- Priority consideration for access to other business assistance programs.

Participating businesses must be: A for-profit company subject to state taxes;

- Pay above-average wages (as compared to other similar firms in the same geographical area with matching NAICS codes);

- Make a significant investment in eligible employee training; and

- Be either a manufacturer or able to document that most of its sales are to Kansas manufacturers and/or out-of-state business or government agencies. A business in any NAICS code can qualify if it is a headquarters or back-office operation of a national or multi-national corporation.

Companies are required to submit a Capital Investment Project Description estimating the scope of anticipated investment before the company commits to any investment on which it expects to claim HPIP investment tax credit.

Child Day Care Assistance Tax Credits

Tax credits are offered against Kansas income tax liability for businesses that pay for or provide child care services for their employees or that provide facilities and necessary equipment for child daycare services.

- During the first year credit of up to 50% of the amount spent to establish a day care facility for employees' dependent children is allowed. The credit cannot exceed $45,000 per taxpayer during the first year. One or more taxpayers may work together to establish such a facility.

- The annual credit available in taxable years after the year of establishment is 30% of the amount expended for annual operation of the facility. The total credit allowed to any taxpayer cannot exceed $30,000 for any tax year.

Research & Development Tax Credits

Taxpayers who invest in research and development (R&D) are entitled to tax credits against their Kansas income tax liability. Qualified R&D expenditures are defined under the U.S. Internal Revenue Code. Qualified R&D expenditures are defined under the U.S. Internal Revenue Code. The credits are based on the amount of current tax year R&D expenditures less average R&D expenditures. The maximum credit is 10% of this amount. Only 25% of the allowable annual tax credit may be claimed in any one year. Any remaining credit may be used in 25% increments against future income tax obligations, until the total amount of credit is exhausted.

Kansas Venture Capital and Seed Capital Credits

A credit for a portion of a taxpayer's investment in Kansas Venture Capital, Inc., Sunflower Technology Venture, LP, or a certified private venture capital company or local seed capital pool may be claimed against its Kansas income tax liability. The amount of the credit will be 25% of the total amount of cash investment. The amount of credit exceeding the taxpayer's liability in any one taxable year may be carried forward until the total amount of credit is used.

Community Service Contribution Tax Credits

Any business firm which contributes to a community service organization or governmental entity which engages in the activities of providing community services is allowed a credit against its Kansas income tax liability. "In kind" contributions of property or services may also qualify for the credit. The credit is 50% of the total amount contributed during the taxable year. However, if the approved community service organization is in a rural community as defined by the law, the credit is 70%. If the credit allowed exceeds tax liability, the excess will be refunded. Non-Kansas taxpayers may transfer the credits to others.

Alternative-Fuel Tax Credits

Expenditures for qualified alternative-fueled motor vehicles or for a qualified alternative-fuel fueling station qualifies for income tax credits. Alternatives fuels are defined under Title 42 of the U.S. Code Section 13211 and include fuels that are substantially not petroleum and yield substantial energy security and environmental benefits. For qualified alternative-fuel motor vehicles, the credit is 40% of the conversion or incremental cost, up to the maximum for the vehicle's gross weight (ranging from $2,400 for GVW under 10,000 pounds to $40,000 for GVW over 26,000 pounds). The credit available for a qualified alternative-fuel fueling station is 40% of the total amount expended up to a maximum of $100,000 for each fueling station. The amount of credit which exceeds tax liability may be carried forward to the next three tax years or until used, whichever is earlier.

Aviation Tax Credits

Beginning July 1, 2022 the state of Kansas created tax incentives to assist aviation sector businesses in recruiting highly skilled talent, starting with the 2022 tax years.

Employee Incentive to Aid in Recruitment

New hires in the aviation sector that qualify can now receive up to $5,000 per year as a state income tax credit through 2026, totaling up to $25,000. The employee must have a degree or certificate from a qualifying program. The nonrefundable credit is available to Kansans and people re-locating to Kansas with a qualifying out-of-state degree or certificate.

Employer Incentive to Hire Qualified Talent

Employers may receive a non-refundable tax credit for 10% of the compensation paid for each new qualified employee (limit of $15,000 per year, per employee) in each of the first five years of employment, adding up to $75,000 in credits per employee. This employer incentive is available for qualifying new employees hired between 2022-2026.

Employer Incentive to Upskill Employees

A third credit is available for companies that reimburse tuition for their employees. The credit reimburses tuition up to 50% of the total provided to the employee. This employer credit can be claimed if the employee graduates from a qualified program within one year of the date of hire. The tax credit can be claimed each year for up to four years if the employee remains employed at the company. Employer credits must be applied against the employer's income tax liability after all other credits allowed; it is not refundable and may not be carried forward.

Other Tax Credit Programs

Kansas offers additional tax credit programs for contributions to a variety of funds and programs. The Historic Preservation Tax Credit is available for the rehabilitation of qualified historic structures. The credit is 25% of qualified expenditures when the total amount of expenditures exceeds $5,000. The Telecommunications Tax Credit is available for specified telecommunications companies. Specified telecommunications companies are those whose primary business is the transmissions of communications in the form of voice, data, signals, or facsimile by wire or fiber optic cables. For all taxable years commencing after Dec. 31, 2000, and with respect to property initially acquired and first placed into service in this state on and after Jan. 1, 2001, there shall be allowed an income tax credit, for an amount equal to the difference between the property tax levied at 33 percent assessment rate and an assessment rate of 25 percent on all taxes actually and timely paid during the appropriate income tax year. Additional Kansas tax credits include the Employer Health Contribution Credit and the Disabled Access Credit.

Missouri

Research Expense Tax Credit Program

In order to induce existing businesses to increase their research efforts, businesses are permitted to claim a tax credit equal to 6.5% of the excess of qualified research expenses during the tax year, over the average amount of qualified research expenses incurred in Missouri during the preceding three tax years. The credit may be carried forward for up to five additional years. The amount of the tax credits cannot exceed $10 million annually.

Beginning January 1, 2023, the Missouri Department of Economic Development (DED) director may authorize a tax credit of either 15% of a taxpayer's qualified research expenses or 20% if the additional research expenses relate to research that is conducted in conjunction with a public or private college or university located in this state.

Brownfield Remediation Program

Any person or business operating an eligible project of redevelopment on

certain abandoned and contaminated commercial/industrial property may be

eligible to earn state income tax credits for new investment and new jobs.

The proposed redevelopment site must have been abandoned or underutilized for at

least three years. The program provides state income tax benefits for up

to 100% of remediation costs. DED will issue 75% of the credits upon

adequate proof of payment of the costs; the remaining 25% will not be issued

until a clean letter has been received from the DNR.

The eligible project must be in a blighted area and must comply with the

Dept. of Natural Resources' environmental conditions. A new company must create

and maintain 10 new jobs, and an existing company must retain 25 jobs to receive

benefits.

Missouri Development Finance Board Tax Credit Programs

Any taxpayer may receive a state tax credit equal to 50% of any amount

contributed to the Industrial Development and Reserve Fund, the Infrastructure

Development Fund, or the Export Finance Fund. Contributions to these funds are

used to make direct loans and loan guarantees to new and expanding businesses

and nonprofit organizations, and to make grants to public entities. Credits may

be transferred or sold and there is a five-year carry-over provision.

Development Tax Credit Program The state

provides income tax credits based on a contribution by a company to a local

non-profit corporation (NPC) for projects approved by the Department of Economic

Development (DED). The amount of credits approved will be based on the economic

impact of the project and the minimum amount of credits required to cause the

project to occur. The purpose of the program is to create full-time, year-round

jobs. The project must be located in a "blighted" or "distressed" area.

Eligible donations include cash, machinery

and equipment, and real estate. The NPC will lease the real or personal property

to a business entity. The lease is structured to facilitate the business'

project and lease payments will be based on the costs of the non-profit to

operate and maintain the subject assets (if any). In most cases the NPC will

provide DED the lease payments received in an amount to repay the tax credits

plus interest. The tax credits may be used in the year received, or for up to

five years if desired. Credits also may be sold or transferred.

New Markets Tax Credit Program

The New Markets Tax Credit (NMTC) is administered by the Community Development

Financial Institutions Fund (CDFI Fund), a branch of the Department of the

Treasury and is designed to stimulate the flow of capital into low-income and

economically-distressed areas by providing investors (corporate or individual)

with a tax incentive for investing in a qualified Community Development Entities

(CDE). The CDE, in turn, is charged with providing capital to low-income areas

by investing in qualified low-income community businesses (QALICB), which can be

a for-profit or not-for-profit business, operating in qualified census tracts.

Participating CDE's are given NMTC allocation authority to offer investors a

federal tax credit equal to 5 percent of the investment amount in each of the

first three years following the initial investment, and a credit equal to 6

percent of the investment amount in each of the following four years. In total,

investors receive a credit equal to 39 percent of the initial investment amount.

The benefit to the QALICB is access to low-cost of capital which can be used to

fund activities including property/land acquisition, construction, equipment

purchase, even working capital.

For more information, please visit kcmo.gov

Other Tax Credit Programs

Missouri offers several programs which provide significant tax credits to businesses making contributions to a variety of projects and funds. Some of the programs include the Small Business Incubator Tax Credit Program, the Neighborhood Assistance Program, the Historic Preservation Tax Credit Program, and the Community Bank Investment Tax Credit Program. Tax credits available range from 25% to 70% of contributions to qualified projects. Effectively, such programs enable businesses to redirect their tax dollars to help finance local job creation, growth of the tax base, elimination of blight, and a variety of other purposes. Some programs allow credits to be used in ensuing tax periods or to be sold or transferred to other taxpayers.

In addition to the state programs outlined below, the Greater Kansas City Chamber of Commerce sponsors a World Trade Center that is engaged in promoting greater Kansas City's international business growth through a variety of programs and projects. And another organization, KC SmartPort, is a non-profit corporation whose objective is to help facilitate transportation and logistics business within the Kansas City area by developing and marketing an international trade processing center or inland port.

INFORMATION ON BOTH KANSAS AND MISSOURI IS PRESENTED BELOW.

Kansas

The Kansas Department of Commerce works with new and existing businesses wishing to expand their service reach to the international marketplace. The department also takes an active role in bringing international business to the state. The state currently has representatives in Brazil, China, Europe, India, Japan, Korea, Mexico and Taiwan involved in both trade promotion and recruitment of investment. Services to Kansas businesses include the following:

- International investment recruitment

- Export assistance to Kansas companies

- Kansas International Trade Show Assistance Program

The Kansas International Trade Show Assistance Program (KITSAP) helps introduce Kansas companies to foreign markets through participation in international trade shows. Eligible companies are those whose products or services originate in Kansas or whose products receive substantial value-added processing in Kansas.

A company must first apply to KITSAP, be approved and then sign and return the KITSAP contract before attending a funded trade show. After the company attends the trade show, the program will reimburse one-half of a company’s eligible direct expenses - up to $3,500 per show. A company may not exceed $7,000 in total combined financial assistance during a state fiscal year (July 1 - June 30).

KITSAP will only consider trade shows where the applicant is exhibiting for the first time or has a new technology/product that is being introduced into that market for the first time.

Missouri

The International Trade and Investment Group in the Business and Community Division of the Missouri Department of Economic Development works to increase the number of Missouri companies exporting; increase the dollar volume of Missouri exports; and to increase the level of foreign investments to the State of Missouri. Building relationships with organizations across the globe creates resource linkages that enhance the competitive position of Missouri firms. There are State of Missouri offices in China, Europe, Japan, Mexico and Taiwan.

The International Trade and Investment Group assists companies with trade information, trade counseling, trade missions, trade shows, business protocol, global market research, agent/distribution searches, competitive analysis, export finance assistance, and certificates of Free Sale.

The state of Missouri Export Finance Program is a cooperative effort between the Missouri Department of Economic Development and the Missouri Development Finance Board. The State of Missouri Export Finance Program focuses on the export finance programs of several federal and international agencies. Missouri companies exporting can use the export finance programs of the Export – Import Bank of the United States (Ex-Im Bank) and the international programs of the Small Business Administration (SBA). There are primarily two programs available to small and medium-sized companies: the Export Working Capital Program and the Export Credit Insurance Program. These programs are designed to help small and medium-sized businesses that have exporting potential obtain export working capital and also mitigate risks in international transactions.

Missouri companies export to countries around the world and often export dependent jobs pay higher wages. Global markets greatly impact export dependent industries in the State of Missouri. If you would like to learn more about the International Trade and Investment Group, please visit their website at www.missouridevelopment.org.

INFORMATION FOR BOTH KANSAS AND MISSOURI IS PRESENTED BELOW.

Kansas

Promoting Employment Across Kansas (PEAK)

PEAK offers "qualified" companies relocating operations to Kansas the ability to retain a significant portion of employee withholding taxes. Qualified companies include both new operations in Kansas as well as relocated operations to the state and qualifying business retention projects as well.

Companies locating in a metropolitan county (Douglas, Johnson, Leavenworth, Shawnee or Wyandotte) and hiring at least 10 new employees within two years or locating in a non-metropolitan county and hiring at least five new employees within two years.

High-impact projects that create 100 new jobs within two years can retain up to 95% of payroll withholding tax for up to a period of 10 years. The number of years that the withholding tax can be retained depends on how much the annual median wage of the jobs at the Kansas worksite will exceed the current county median wage and the discretion of the Secretary of the Kansas Department of Commerce.

If the aggregate median wage of the new jobs does not qualify the project for PEAK, the annual average wage of the new jobs can be used. Qualifying through the use of the average wage limits the benefits received.

| PEAK Median Wage by County (effective as of 7.01.23) |

|

County

|

Hourly Median Wage |

Annual Median Wage

|

| Atchison |

$17.85

|

$37,137 |

| Douglas |

$18.31 |

$38,086 |

| Franklin |

$19.37 |

$40,288 |

| Johnson |

$22.62 |

$47,049 |

| Leavenworth |

$22.85 |

$47,528 |

| Miami |

$20.46 |

$42,551 |

| Shawnee |

$20.37 |

$42,376 |

| Wyandotte |

$22.87 |

$47,577 |

Source: Kansas Department of Commerce

A PEAK application must be submitted before locating or creating PEAK-eligible jobs in Kansas.

Missouri

Missouri Works

Missouri Works includes five job creation categories: Rural Works; Zone Works; Statewide Works; Mega Works 120; and Mega Works 140. The benefit period for each category is five years from the date the new jobs are created (six years for companies with 10+ years in Missouri). The minimum required number of jobs –and capital investment if applicable – must be created within two years of the Notice of Intent (NOI) approval. The first job must be hired within one (1) year of the NOI approval.

To qualify for any of the Missouri Works categories, a company must offer health insurance and pay at least 50% of the premium for all full-time employees. Incentive awards are partially subject to available funding and customary due diligence procedures. Specific eligibility criteria are as follows:

The Zone Works and Rural Works categories require that the company located its project facility in an approved Enhanced Enterprise Zone, pay a minimum average wage for at least two (2) new jobs equal to 80% of the county average wage, make a capital investment of at least $100,000, and satisfy additional criteria to be eligible for 100% retention of withholding tax.

The Statewide Works category is available for projects that locate anywhere in the state and pays a minimum average wage for at least ten (10) new jobs equal to 90% of the county average wage. Businesses that meet the specific criteria are eligible for 100% retention of withholding tax. This category also offers the potential for additional discretionary tax credits.

The Mega Works 120 and Mega Works 140 categories are available for projects that locate anywhere in the state, and pay a minimum average wage for at least 100 new jobs equal to 120% and 140%, respectively, of the county average wage. Businesses that meet specific criteria are eligible for an automatic benefit equal to a percentage of new payroll.

Businesses receive that benefit by retaining 100% of wage withholding tax with the balance in refundable tax credits. These two (2) categories also offer the potential for additional discretionary tax credit benefits.

| Annual Average Wages by County (effective until 6.30.24) |

|

County

|

Rural/Non-rural |

Annual Average Wage

(MERIC) |

| Buchanan |

Non-rural

|

$55,399

|

| Cass |

Rural

|

$44,367

|

| Clay |

Non-rural

|

$59,547

|

| Clinton |

Rural

|

$44,024

|

| Jackson* |

Non-rural

|

$60,159

|

| Johnson |

Rural

|

$38,861

|

| Lafayette |

Rural

|

$40,539

|

| Livingston |

Rural

|

$40,948

|

| Platte |

Non-rural

|

$59,297

|

| Ray |

Rural

|

$42,941

|

| MISSOURI |

|

$60,159

|

Note: Sections 620.2000 to 620.2020, shall be known and may be cited as the "Missouri Works Program."

*Statewide average of $60,159 applicable to any county over the statewide average when determining program eligibility.

INFORMATION FOR BOTH KANSAS AND MISSOURI IS PRESENTED BELOW.

Kansas

Exemption of Property for Economic Development Purposes Counties and cities may exempt from ad valorem taxation all or any portion of the appraised value of all buildings, or added improvements, together with the land upon which such buildings are located, and all associated tangible personal property used exclusively by a business for:

- Manufacturing articles of commerce;

- Conducting research and development; or

- Storing goods or commodities which are sold or traded in interstate commerce.

The property must be associated with a business which is new to a county, and if the property was already in Kansas prior to the exemption, the city or county must make a determination that if not for the exemption, Kansas would have lost jobs. Additions to or expansions of existing buildings qualify for the property tax exemptions, if, as a result of the expansion, new jobs are created.

Total or partial ad valorem tax exemption may be in effect for up to 10 years after the calendar year in which a business commences its operations or an expansion is completed. Any property tax abatement is the decision of the city or county.

Machinery & Equipment Personal Property Tax Exemption

Commercial and industrial machinery and equipment acquired by qualified purchase or lease, or transferred into the state, is exempt from state and local property tax. This exemption pertains to machinery and equipment used in the expansion of an existing facility or the establishment of a new facility. The exemption covers machinery and equipment used in manufacturing or warehousing/distribution, commercial equipment, computer, desks and chairs, copiers and fax machines.

Businesses Using Industrial Revenue Bonds

Property financed with Industrial Revenue Bonds (IRBs) is exempt from ad valorem taxation for up to 10 years after the bonds are issued. However, localities may elect to negotiate "payments in lieu of taxes."

Inventory Exemption

All merchants' and manufacturers' inventories are exempt from property taxes by constitutional amendment.

Intangible Property

Intangible property taxes are local taxes levied by counties, cities, and townships. The law permits a tax of 3% or less on the income derived from intangible property. However, counties, cities, and townships have the option of reducing or eliminating the tax. The six Kansas counties in the metropolitan area have eliminated their shares of the tax, and most cities in those counties have eliminated all or part of the tax.

Missouri

Enhanced Enterprise Zone Property Tax Benefits

The Enhanced Enterprise Zone is a program offering eligible investment expenditures include the original cost of machinery, equipment, furniture, fixtures, land and building, and/or eight (8) times the annual rental rate paid for the same.

Inventory Exemption

Manufacturer's inventories including raw materials, goods in process and finished goods, as well as goods and wares of retailers, distributors, and wholesalers are exempt from all state and local property taxes.

Chapter 100 Bonds

Chapter 100 authorizes cities and counties to issue industrial development bonds to finance a wide variety of commercial facilities and equipment, and to offer real and/or personal property tax abatement, sales tax exemption on construction materials and/or sales tax exemption on tangible personal property. The terms and abatement percentages are typically determined at the local level.

There are many exemptions to sales and use taxes in both Kansas and Missouri. The following represent a few of the major exemptions.

INFORMATION FOR BOTH KANSAS AND MISSOURI IS PRESENTED BELOW.

Kansas

The Kansas state sales and use tax rates is 6.5%. However, there are several sales tax exemptions available which include:

- Labor services related to original construction

- Remodeling costs, furnishings, furniture, machinery and equipment for qualified projects

- New machinery and equipment for manufacturing and distribution. This also includes pre- and post-production machinery and equipment, including raw material handling, waste storage, water purification and oil cleaning, as well as ancillary property such as gas pipes, electrical wiring and pollution control equipment.

- Tangible personal property that becomes an ingredient or component part of a finished product

- Tangible personal property that is immediately consumed in the production process, including electric power, natural gas and water

- Incoming and outgoing interstate telephone or transmission services (WATTS)

- Real and personal property financed with an Industrial Revenue Bond

Missouri

Machinery, equipment, and energy directly used to manufacture a product ultimately intended for sale is exempt from state sales tax and local use tax, but not local sales tax. Manufacturers’ inventories (raw materials, goods in process and finished goods) are exempt from inventory taxes.

Chapter 100 Bonds

Chapter 100 authorizes cities and counties to issue industrial development bonds to finance a wide variety of commercial facilities and equipment, and to offer real and/or personal property tax abatement, sales tax exemption on construction materials and/or sales tax exemption on tangible personal property. The terms and abatement percentages are typically determined at the local level.

INFORMATION FOR BOTH KANSAS AND MISSOURI IS PRESENTED BELOW.

Kansas

The state of Kansas has two workforce training programs to offset a company's training costs:

- Kansas Industrial Training (KIT)

- Kansas Industrial Retraining (KIR)

Companies creating new jobs may quality for Kansas Industrial Training (KIT) assistance. Eligibility for the program depends on the number of jobs created and the corresponding wages. The state of Kansas also has the Kansas Industrial Retraining (KIR) program to retain a Kansas company's existing workforce on new technology or production activities. Projects involving a Kansas Basic Industry—which includes manufacturing, distribution or regional/national service facilities—may qualify for these programs.

Both of these programs offer direct financial assistance to pay a negotiated portion of the costs to train a company's employees. Companies may apply the assistance toward items such as instructors' salaries; meals, travel and lodging (including out-of-state or international travel); video development; textbooks and training manuals; supplies and materials; temporary training facilities and curriculum planning and development.

Missouri

Missouri One Start

As the state’s principal workforce development program, Missouri One Start provides businesses with comprehensive pre-employment and customized training solutions. The Missouri One Start Network has the resources to meet each business’s unique needs. Missouri One Start specializes in providing custom-built training programs specifically for each business. That plan may include one-on-one recruitment services, and pre- and post-employment training. Training might take place in a classroom setting, on-the-job, at a company facility, or in a training center within the Missouri One Start Network.

Utility companies serving metropolitan Kansas City offer financial incentives to qualifying customers. These economic development riders and business incentive plans are designed to encourage industrial and commercial development by providing additional start-up cost savings to large users of natural gas and electricity. Incentives are also available for smaller users in the urban core.

Qualifications are based on load requirements and/or demand levels of the customer's utility usage. Utilities on both sides of the state line may offer qualified customers a five-year decreasing (or potential increasing) discounts schedule equivalent to, or nearly equivalent to, one free year of service. Cost saving estimates and information on the incentive programs are available to qualifying customers from the specific utility company and/or the Kansas City Area Development Council.

Kansas

Kansas files several types of business fees and attaches a different filing fee for each formation document. For example, there is a $85-$90 filing fee for domestic for profit corporations and a $75 filing fee for foreign (non-Kansas) corporations. Each year business entities are required to file an annual report and pay a filing fee. The articles of formation may be amended by filing the appropriate amendment document with a filing fee. Many business filings may be completed electronically. Please visit the Business Filing Center. Paper forms are available in the Filings & Forms section of the web site.

Missouri

Missouri's initial fee for a domestic corporation is $50 on the first $30,000 shares/authorized capital, plus $5 tech fee, plus $3 for the certificate, for a minimum total of $58. Plus $5 on each additional $10,000 shares/authorized capital. For foreign (non-Missouri) corporations, Missouri assesses a $155 fee for issuance of a certificate of authority to do business in Missouri. Foreign and domestic corporations pay $45 annually ($20 on-line) for registration with the Secretary of State's office.

Kansas

The state of Kansas has no corporate franchise tax.

Missouri

The state of Missouri has no corporate franchise tax.

Both states administer an income tax measured by net income of the corporation. The determination of taxable income begins with net taxable income reported for federal income tax purposes. Both states permit deduction of operating expenses from gross income in arriving at net taxable income.

| Corporate Income Tax Rates |

| Kansas |

4% of net taxable income. In addition, income in excess of $50,000 is subject to a 3.0% surtax.

|

| Missouri |

4% of net taxable income earned in the state. (Note that Missouri allows 50% of federal income tax payments to be deducted before computing taxable income.)

|

INFORMATION FOR BOTH KANSAS AND MISSOURI IS PRESENTED BELOW.

Kansas

Kansas corporate taxable income is defined as federal taxable income with numerous state adjustments. Kansas does not allow a deduction for federal or state income taxes.

The rate of tax is 4% of net taxable income. In addition, a 3% surtax is imposed on income in excess of $50,000. A corporation must make quarterly estimated tax payments if its Kansas income tax liability can reasonably be expected to exceed $500.

For those corporations having facilities both inside and outside Kansas, the net income attributed to the Kansas operation is based upon the percentage of the corporation's business located in Kansas. A business's tax obligation is determined by a three-factor formula that considers the proportion of sales, property, and dollar payroll attributable to the Kansas facility.

Corporations may opt for a two-factor (sales and property) apportionment formula to calculate tax liability if the payroll factor for a taxable year exceeds 200% of the average of the property and sales factors. Also, the state allows net operating losses to be carried forward for each of the 9 years following the tax year of the net operating loss.

Investment funds service companies headquartered in Kansas and employing 100 individuals on a full-time basis are taxed only on their income earned from the administration of funds of Kansas residents.

Alternative accounting methods can be approved by the Secretary of Revenue to effect an equitable allocation and apportionment of a taxpayer's income.

Job creation and investment tax credits are available state-wide to businesses which create new jobs and investment, by locating, expanding, or renovating within the state of Kansas.

Visit the Kansas Department of Revenue for more information, 2022.

Missouri

Missouri corporate income tax is based on federal taxable income with adjustments for state income taxes, interest from exempt federal obligations, and other less common adjustments.

The tax rate for corporations is 4% applied to Missouri taxable income. In addition, Missouri allows 50% of federal income tax payments to be deducted before computing taxable income. Using the deduction, a corporation with a taxable income of $1 million would have a Missouri effective tax rate of only 5.2%. Estimates must be filed and quarterly payments made, if the tax is reasonably expected to exceed $100.

For corporations conducting business both inside and outside Missouri, only income earned in Missouri is taxed. Two allocation options are offered for calculating this income: 1) a single-factor formula based on sales, or 2) a three-factor formula based on property, payroll, and sales. Missouri is the only state that permits companies to choose the formula that results in the lesser corporate income tax liability.

Kansas City, Missouri, imposes a tax at the rate of 1% on net profits earned by all corporations as a result of work done or services performed within its boundaries. Federal and state income taxes are not deductible, but local taxes paid are deductible. Apportionment of earnings, where the company has established places of business both in and out of the city, is made by use of a three-factor formula based on property, payroll, and sales.

A variety of benefits, including an array of income tax credits, are available to companies which create new jobs and new investment within Missouri.

Visit the Missouri Department of Revenue for more information, 2020.

Both the state of Kansas and the state of Missouri use a graduated tax rate schedule based on net taxable income. Personal exemptions, itemized deductions, or standard deductions are applied to gross income to obtain net taxable income.

INFORMATION FOR BOTH KANSAS AND MISSOURI IS PRESENTED BELOW.

Kansas

Effective Tax Year 2023, the tax rate for individual taxpayers ranges from 3.1% to 5.7% based on the table below. The tax rate for joint returns ranges from 3.1% to 5.7%.

| Rates for individuals |

|

If taxable income is:

|

The tax rate is:

|

| $2,501 - $15,000 |

3.1%

|

| $15,001 - $30,000 |

5.25% plus $323.00

|

| $30,001 and over |

5.7% plus $458.00 |

| Rates for joint returns |

|

If taxable income is:

|

The tax rate is:

|

| $5,001 - $30,000 |

3.1%

|

| $30,001 - $60,000 |

5.25% plus $645.00

|

| $60,001 and over |

5.7% plus $915.00 |

Kansas taxable income is reduced by the amounts of various standard and itemized deductions. The standard deduction amount for single filers is $3,500, head-of-household filers is $6,000 and married taxpayers filing jointly is $8,000.

Visit the Kansas Department of Revenue for more information, 2023.

City Earnings Taxes

No cities within Kansas impose an earnings tax, however, Kansas residents who work in Kansas City, Missouri are subject to the Kansas City, Missouri earnings tax.

Missouri

The 2023 tax rate for individuals ranges from 2.00% on the first $1,207 of taxable income to 4.95% of taxable income over $8,4490. Missouri taxable income is reduced by the amounts of various standard and itemized deductions. The standard deductions include: a portion of federal income tax paid (up to $13,850 on a single return and $27,700 on a joint return), $1,200 for each dependent, as well as the federal standard deduction for a married couple filing jointly who does not itemize deductions.

| Missouri Tax Rates |

|

If taxable income is:

|

The tax rate is:

|

| $0 - $1,207 |

$0 |

| Over $1,207 but not over $2,414 |

2.00% of excess over $1,207

|

| Over $2,414 but not over $3,621 |

$24 plus 2.50% of excess over $2,414

|

| Over $3,621 but not over $4,828 |

$54 plus 3.00% of excess over $3,621

|

| Over $4,828 but not over $6,035 |

$90 plus 3.50% of excess over $4,828

|

| Over $6,035 but not over $7,242 |

$132 plus 4.00% of excess over $6,035

|

| Over $7,242 but not over $8,449 |

$180 plus 4.50% of excess over $7,242

|

| Over $8,449 |

$234 plus 4.95% of excess over $8,449

|

Visit the Missouri Department of Revenue for more information, 2023.

City Earnings Taxes

The city of Kansas City, Missouri, imposes a tax of 1% on salaries, wages, and commissions earned by individuals living or working in Kansas City, Missouri

A variety of services are offered by local municipalities, which must be carefully considered in conjunction with property tax rates. Throughout the metropolitan area, there are numerous taxing authorities for services such as schools, junior colleges, fire prevention, sewer and water, drainage, and hospitals. All of these taxing authorities may impose levies in any given community, thus, tax rates will vary for every municipality.

INFORMATION FOR BOTH KANSAS AND MISSOURI IS PRESENTED BELOW.

Kansas

The local property tax rate is an aggregate of state, county, city, school, and other district levies expressed as tax per $1,000 of assessed valuation. All real property is subject to ad valorem taxation unless expressly exempt. Examples of exemptions are:

- Merchants’ and manufacturers’ inventories.

- Personal property moving through the state or consigned to a warehouse in Kansas from a point outside Kansas in transit to a final destination outside Kansas.

- Real and tangible personal property used exclusively for literary, educational, scientific, religious, or charitable purposes.

- Aircraft used predominantly in the conduct of business.

The Department of Revenue's Division of Property Valuation is the state agency exercising general supervision over ad-valorem policies and procedures in Kansas.

Assessment Ratios

- Commercial and industrial real property is assessed at 25% of fair market value.

- Residential property is assessed at 11.5% of fair market value.

- Real property owned and operated by not-for-profit organizations and vacant lots are assessed at 12% of fair market value.

- Agricultural land, mineral leasehold interests, and motor vehicles are assessed at 30% of fair market value.

- Public utility real and personal property is assessed at 33% of fair market value.

Real Property

Most real property is appraised at its fair market value with the exception of agricultural land. Property is assessed by the county appraiser in the taxing district in which the property is located.

Tangible Personal Property

Commercial and industrial machinery and equipment acquired by qualified purchase or lease, or transferred into the state, is exempt from state and local property tax. This exemption pertains to machinery and equipment used in the expansion of an existing facility or the establishment of a new facility. The exemption covers machinery and equipment used in manufacturing or warehousing/distribution, commercial equipment, computer, desks and chairs, copiers and fax machines.

Intangible Personal Property

Kansas law permits the imposition of a 3% or less intangible personal property tax on the income derived from all money, securities, credits, notes or other evidences of indebtedness. Counties, cities, and townships have the option of reducing or eliminating the tax. The six Kansas counties in the metropolitan area have eliminated their shares of the tax, and most cities in those counties have eliminated all or part of the tax.

Non-Business Personal Property

The county appraiser has the responsibility to value watercraft and trailers at market value and is assessed at 30%. Taxes on autos, light and medium trucks and motorcycles are due at the time of registration and the value is depreciated 15% per year of the manufacturer's suggested retail price.

Missouri

The local property tax rate is an aggregate of school, city, county, and state levies expressed as tax per $100 of assessed valuation. Property is assessed on the basis of "fair or true market value." All property, real and tangible personal, is taxable unless expressly exempt. Examples of exemptions include:

- Inventories of retail merchants, manufacturers, and wholesalers, including raw materials and goods in process.

- Property “actually and regularly used exclusively” by an exempt organization pursuant to its exempt purposes and not held for private or corporate profit.

The State Tax Commission of Missouri is the agency charged with overseeing Missouri's property tax system.

Assessment Ratios

- Commercial and industrial real property is assessed at 32% of fair market value.

- Tangible personal property, not elsewhere classified, is assessed at 33 1/3% of fair market value.

- Residential property is assessed at 19% of fair market value.

- Agricultural property is assessed at 12% of productive value.

Real Property

All property is appraised at its fair or true market value by the county. Commercial and industrial real property (i.e., land and buildings) is assessed an additional county surcharge designed to replace revenue losses attributable to the tax exemption of business inventories.

Tangible Personal Property

Assessed values of tangible personal property in Missouri are set at 33 1/3% of fair or true market value. Most counties in the metropolitan area use formulas under which original costs of depreciable personal property are discounted to determine true values. Tangible personal property includes machinery and equipment.

Intangible Personal Property

There is no tax on intangible personal property.

Non-Business Personal Property

The state has authorized local governments to apply a tax based on the actual cash value of licensed motor vehicles (automobiles, trucks and motorcycles), boats, motors, trailers and campers. The assessment ratio for this type of property is 33 1/3%. The assessment ratio for livestock is 12% and 0.5% for grain and crops.

Effective 2022 Real Property Tax Rates (%)

in Selected Municipalities |

|

KANSAS

|

Commercial,

Real |

Residential, Real |

Individual Personal |

| Atchison, Atchison Co. |

4.26

|

1.96

|

5.11

|

| Bonner Springs, Wyandotte Co. |

4.01

|

1.84

|

4.81

|

| De Soto, Johnson Co. |

2.47

|

1.14

|

2.96

|

| Edwardsville, Wyandotte Co. |

4.15

|

1.91

|

4.98

|

| Gardner, Johnson Co. |

2.32

|

1.07

|

2.79

|

| Kansas City, Wyandotte Co. |

4.14

|

1.90

|

4.97

|

| Lawrence, Douglas Co. |

3.30

|

1.52

|

3.96

|

| Leavenworth, Leavenworth Co. |

3.03

|

1.39

|

3.63

|

| Leawood, Johnson Co.(1) |

2.10

|

0.97

|

2.52

|

| Lenexa, Johnson Co.(1) |

2.12

|

0.97

|

2.54

|

| Merriam, Johnson Co. |

2.15

|

0.99

|

2.58

|

| Olathe, Johnson Co.(1) |

2.10

|

0.97

|

2.53

|

| Osawatomie, Miami Co. |

4.55

|

2.09

|

5.46

|

| Ottawa, Franklin Co. |

4.22

|

1.94

|

5.06

|

| Overland Park, Johnson Co.(1) |

1.86

|

0.86

|

2.24

|

| Paola, Miami Co. |

3.39

|

1.56

|

4.07

|

| Prairie Village, Johnson Co. |

2.14

|

0.98

|

2.56

|

| Shawnee, Johnson Co. |

2.02

|

0.93

|

2.42

|

| Topeka, Shawnee Co. |

3.97

|

1.83

|

4.76

|

|

MISSOURI

|

Commercial, Real |

Residential, Real |

Individual Personal |

| Belton, Cass Co. |

2.90

|

1.62

|

2.83

|

| Blue Springs, Jackson Co. |

3.36

|

1.72

|

3.01

|

| Cameron, Clinton Co. |

2.30

|

1.29

|

2.26

|

| Chillicothe, Livingston Co. |

2.48

|

1.35

|

2.37

|

| Claycomo, Clay Co. |

2.75

|

1.33

|

2.33

|

| Excelsior Springs, Clay Co. |

2.94

|

1.44

|

2.53

|

| Gladstone, Clay Co. |

2.87

|

1.40

|

2.46

|

| Grain Valley, Jackson Co. |

3.30 |

1.68 |

2.95 |

| Grandview, Jackson Co. |

3.21

|

1.63

|

2.86

|

| Harrisonville, Cass Co. |

2.35 |

1.29 |

2.26 |

| Independence, Jackson Co. |

2.82

|

1.40

|

2.26

|

| Kansas City, Clay Co.(2) |

3.18

|

1.59

|

2.78

|

| Kansas City, Jack. Co.(1),(2) |

3.09

|

1.56

|

2.74

|

| Kansas City, Platte Co.(2) |

2.78

|

1.58

|

2.78

|

| Kearney, Clay Co. |

2.77

|

1.34

|

2.35

|

| Lee’s Summit, Jackson Co. |

3.04

|

1.53

|

2.69

|

| Lexington, Lafayette Co. |

2.39

|

1.34

|

2.35

|

| Liberty, Clay Co. |

2.98

|

1.47

|

2.57

|

| North Kansas City, Clay Co. |

2.84

|

1.38

|

2.32

|

| Parkville, Platte Co. |

2.73

|

1.55

|

2.72

|

| Platte City, Platte Co. |

2.58

|

1.47

|

2.24

|

| Pleasant Hill, Cass Co. |

2.47 |

1.36 |

2.39 |

| Raymore, Cass Co. |

2.75

|

1.53

|

2.68

|

| Raytown, Jackson Co. |

3.47

|

1.79

|

3.13

|

| Richmond, Ray Co. |

2.44

|

1.39

|

2.44

|

| Riverside, Platte Co. |

2.22

|

1.25

|

2.19

|

| Smithville, Clay Co. |

2.82

|

1.37

|

2.29

|

| St. Joseph, Buchanan Co. |

2.22

|

1.14

|

2.01

|

| Warrensburg, Johnson Co. |

2.49

|

1.47

|

2.58

|

(1) Significant portions of these cities are served by more than one school district; the rate shown reflects the levy of the school district in which residents predominately reside. |

| (2) The City of Kansas City, Mo. imposes an additional levy on land that does not apply to improvements. The rates shown here do not reflect this special land levy. |

| Note: Effective rates are estimates based on the sum of levies for all major taxing jurisdictions and each state's appropriate assessment ratio. The rates above reflect the "typically" applicable levies in a municipality. In reality, a range of possible levy totals exist in most of the major communities. The most important source of variation is likely to be school district (see note 2 above), but other special districts may account for differences as well. |

| Source: County Clerks |

Sales tax is applicable on all sales made from a location within a state. Use tax applies to property for use, storage, or consumption that was purchased from an out-of-state vendor.

INFORMATION FOR BOTH KANSAS AND MISSOURI IS PRESENTED BELOW.

Kansas

The sales tax is the total of state and local rates and is applied to all retail purchases plus taxable services sold at retail to the consumer. Kansas levies a 6.5% sales and use tax. If applicable, an additional levy may be imposed by the city or county in an amount that will vary.

If the sale or use of property has already been subject to a tax of less than 6.3% by any state, then the tax is the difference between 6.3% and the tax that has already been imposed.

Missouri

The state of Missouri levies a 4.225% sales/use tax on purchases other than retail sales of food. Food is taxed by the state at 1.225%. The sales tax is applied to all retail purchases plus taxable services such as utilities sold at retail to the consumer. Counties in the metro area impose levies ranging from 0.75% to 2.00%. Local county and municipal sales taxes apply to food as well as other retail purchases. However, many local counties and municipalities do not impose any use tax above the state rate.

If the sale or use of property has already been subject to a tax of less than 4.225% by any state, then the tax is the difference between 4.225% and the tax that has already been imposed.

| Sales Tax Rates in Selected Municipalities (%) |

|

KANSAS (1)

|

SALES |

USE |

| Atchison, Atchison Co. |

8.500 |

6.50 |

| Basehor, Leavenworth Co. |

8.500 |

6.50 |

| Bonner Springs, Wyandotte Co. |

9.250 |

6.50 |

| De Soto, Johnson Co. |

9.725 |

6.50 |

| Edwardsville, Wyandotte Co. |

9.000 |

6.50 |

| Gardner, Johnson Co. |

9.475 |

6.50 |

| Kansas City, Wyandotte Co. |

9.125 |

6.50 |

| Lansing, Leavenworth Co. |

9.400 |

6.50 |

| Lawrence, Douglas Co. |

9.300 |

6.50 |

| Leavenworth, Leavenworth Co. |

9.500 |

6.50 |

| Leawood, Johnson Co. |

9.100 |

6.50 |

| Lenexa, Johnson Co. |

9.350 |

6.50 |

| Louisburg, Miami Co. |

9.500 |

6.50 |

| Merriam, Johnson Co. |

9.475 |

6.50 |

| Olathe, Johnson Co. |

9.475 |

6.50 |

| Osawatomie, Miami Co. |

9.750 |

6.50 |

| Ottawa, Franklin Co. |

9.600 |

6.50 |

| Overland Park, Johnson Co. |

9.100 |

6.50 |

| Paola, Miami Co. |

9.250 |

6.50 |

| Prairie Village, Johnson Co. |

8.975 |

6.50 |

| Shawnee, Johnson Co. |

9.600 |

6.50 |

| Spring Hill, Miami Co. |

9.500 |

6.50 |

| Tonganoxie, Leavenworth Co. |

9.250 |

6.50 |

| Topeka, Shawnee Co. |

9.350 |

6.50 |

|

MISSOURI (2)

|

SALES |

USE |

| Belton, Cass Co. |

9.100 |

5.850 |

| Blue Springs, Jackson Co. |

8.225 |

4.225 |

| Cameron, Clinton Co. |

9.475 |

5.225 |

| Chillicothe, Livingston Co. |

7.975 |

7.975 |

| Excelsior Springs, Clay Co. |

8.975 |

8.850 |

| Gladstone, Clay Co. |

8.475 |

8.350 |

| Grain Valley, Jackson Co. |

8.725 |

4.225 |

| Grandview, Jackson Co. |

8.725 |

7.225 |

| Independence, Jackson Co. |

8.100 |

6.475 |

| Kansas City, Clay Co. |

8.725 |

8.350 |

| Kansas City, Jackson Co. |

8.975 |

7.225 |

| Kansas City, Platte Co. |

8.725 |

8.600 |

| Kearney, Clay Co. |

8.475 |

5.350 |

| Lee’s Summit, Jackson Co. |

7.850 |

6.475 |

| Liberty, Clay Co. |

8.850 |

8.725 |

| North Kansas City, Clay Co. |

7.475 |

5.350 |

| Raytown, Jackson Co. |

8.475 |

4.225 |

| Richmond, Ray Co. |

9.225 |

8.725 |

| Riverside, Platte Co. |

6.975 |

6.600 |

| St. Joseph, Buchanan Co. |

9.700 |

8.450 |

| Warrensburg, Johnson Co. |

9.475 |

8.850 |

(1) The state use tax in Kansas is 6.15%. No local compensating taxes are due unless the item purchased or leased is a motor vehicle, trailer, or vessel that is required to be registered.

(2) These are non-food rates; for food purchases, subtract 3% from each Missouri community's rate.

Source: Kansas Department of Revenue, 2023 & Missouri Department of Revenue, 2023.

INFORMATION FOR BOTH KANSAS AND MISSOURI IS PRESENTED BELOW.

Kansas

Kansas does not have a fixed rate schedule—positive balance employers’ rates are adjusted annually based on the ratio of the size of the fund balance to total payroll. For 2019, positive balance employers pay between 1% and 2.7%. Negative balance employers pay between 5.6% and 7.6% (that is, 5.4% plus a surcharge of 0.2% to 2.0% based on the size of the negative reserve ratio, plus an additional surcharge to pay interest on the loan from the Federal UI which ranges from 0.10% to 2.0%). Unemployment insurance rates are applied to the first $14,000 in wages paid annually to each employee.

If an employer already has a facility in Kansas and has established an experience rating, the employer will have the same tax rate for any new facility built in Kansas. New companies locating in the state receive an entry rate based on the type of business. After three years, when original liability is established before July 1, the employer may have a tax rate computed with experience rate factors. When liability is established after June 30, the employer may have a computed rate after four years. Employers who are not eligible for a rate computation shall pay contributions at the rate of 2.7 percent, except for employers in the construction industry, who will pay at the rate of six percent.

The maximum weekly benefit cap is the greater of either $474 or 55.0% of the average weekly wages paid to employees in insured work during the previous calendar year for up to 16 weeks. Employees dismissed without misconduct are eligible to receive benefits after a one-week waiting period. An employee who voluntarily quits without good cause attributable to the work or to the employer or an employee who was discharged for misconduct connected with the work may be disqualified from receiving benefits. Disqualifications are explained in more detail in the complete Kansas Employer Handbook.

The Kansas Department of Labor oversees unemployment insurance in Kansas.

Shared Work Unemployment Insurance

In lieu of a layoff, an employer may divide the workday among a group of affected employees. Under the shared work unemployment insurance program, employees are allowed to receive a portion of their unemployment insurance benefits while working reduced hours. This program is only available to employers with a positive account balance.

Missouri

In Missouri, the unemployment insurance tax is levied on the first $10,500 of an employee’s annual compensation. The taxable wage base can increase in increments of $1,000 or decrease in increments of $500, depending on the state’s unemployment fund balance, but it cannot fall below the federally required minimum of $7,000. In 2023, the normal entry rate set for a new employer is contingent upon the type of business involved, however, all new employers pay 2.511%, even for those in the construction-related industries. The contribution rate for nonprofit and governmental employers is 1.00%.

Thus, a new employer’s cost per employee would be 2.511% of $10,500 or $264.00. An employer may qualify for a rate below the entry rate based on at least a 12-month benefit charge ability. A new employer may qualify for a rate based on a predecessor’s experience in the case of an acquisition of a business. The maximum unemployment benefit is $320 per week for up to 20 weeks.

Many states have had to adopt the usage of surtaxes to defray the costs of benefits attributed to the severity and duration of the most recent recessionary period. The surtax in Missouri is based on the unemployment compensation fund balance and increases rates by 10, 20, or 30% of the tax due or reduces rates by seven or 12% of tax due, depending on the balance in the fund.

The Department of Labor and Industrial Relations' Division of Employment Security oversees unemployment insurance in Missouri.

Shared Work Program

This program was initiated to encourage job retention. Under the program, employers reduce work hours a certain percentage, rather than lay off employees. Those employees then receive both wages for actual hours worked, and partial unemployment insurance benefits.

Workers’ compensation provides benefits to injured employees for accidents or occupational diseases arising out of, and in the course of, their employment. Compensation coverage is available through private insurance carriers licensed by the state, but self-insurance is allowed in both states with approval from the states’ Division of Workers’ Compensation.

Costs vary for individual businesses and are dependent upon type of employment (occupational risk), estimated annual remuneration, and the company’s loss experience.

INFORMATION FOR BOTH KANSAS AND MISSOURI IS PRESENTED BELOW.

Kansas